LITE from $100 to $250

Lite account feauture: 2.5% daily

- ✓ Daily profit

- ✓ 24/7 customer support

- ✓ 10% referral commision

- ✓ 24/7 Access to account on web/app

- ✓ Instant withdrawal

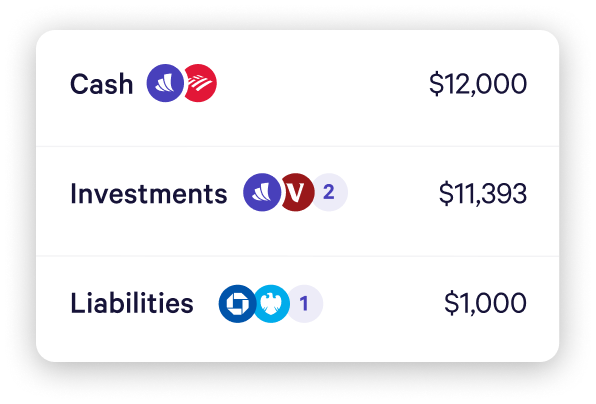

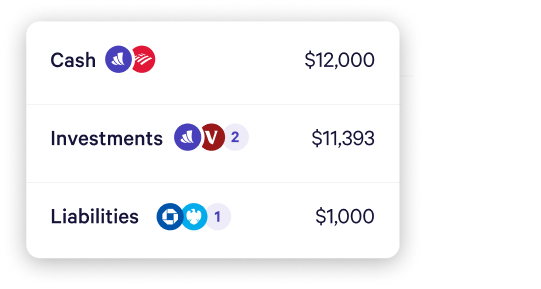

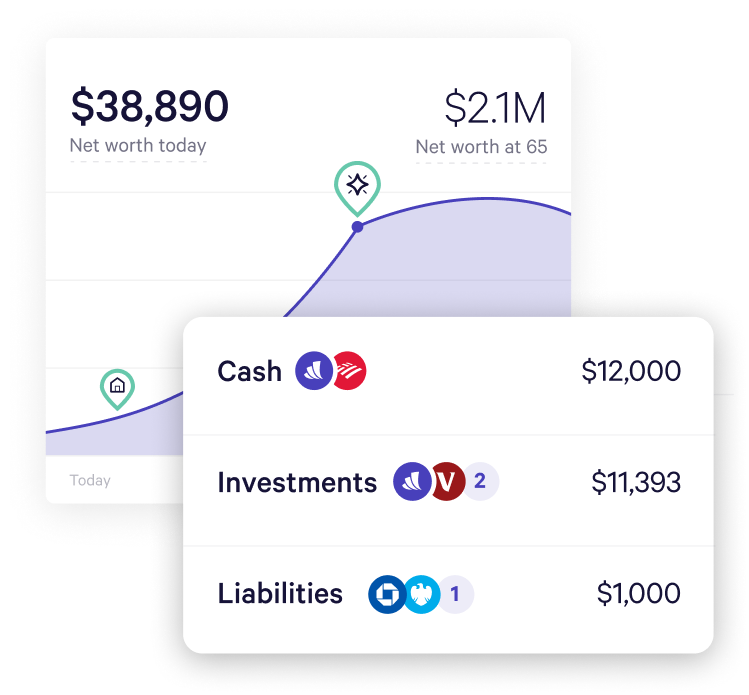

This overview of Starter Account explains the framework we use to construct our clients’ portfolios.