Upgrade

Your Banking.

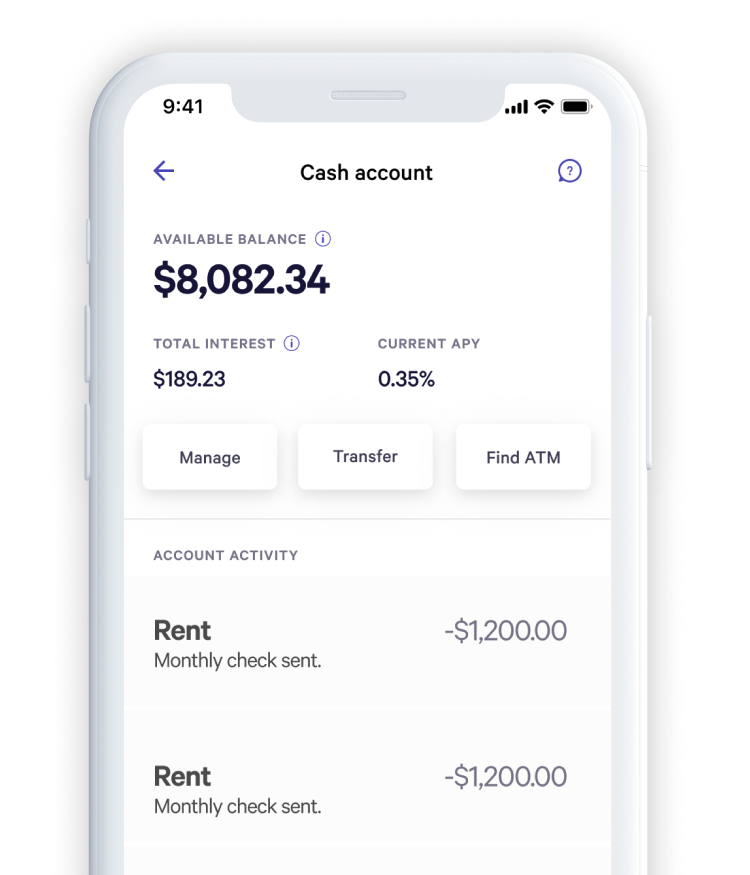

The High Margin Brokerage Cash Account offers high-interest checking with no account fees. Enjoy 0.35% APY, get paid up to two days early when you direct deposit, pay bills and friends, and easily access cash with a debit card.

Put extra cash to work easily when you’re ready to invest. The High Margin Brokerage Cash Account is a product offered by High Margin Brokerage Brokerage in partnership with Green Dot Bank.

Get StartedEarn more on your paycheck.

Get paid up to two days earlier.

Why should you wait to get paid?

Set up direct deposit with the Cash Account and get your paycheck up to two days early. The earlier you get your paycheck, the more time you have to earn interest.

Earn more, keep more.

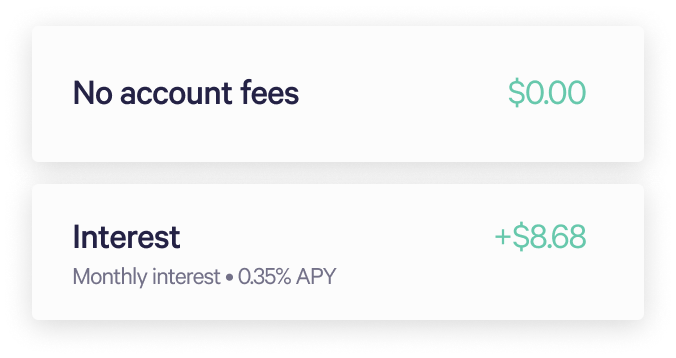

No account fees.

0.35% APY.

That’s 8x the national average of 0.04% per FDIC.gov.

Don’t let fees eat into what you earn. Skip typical bank fees.

- No account minimum fee

- No monthly service fee

- No withdrawal overdraft fee

- No debit card overdraft fee

- No excess activity fee

- No stop payment fee

- No fees at 19,000 ATMs

Fast Access to Every Penny.

Enjoy Checking Features.

Earn interest on your everyday cash and

get your money when you need it.

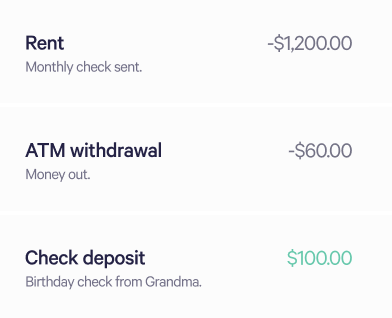

- Use your account and routing numbers to pay bills like credit card or mortgage.

- Get cash from 19,000 free ATMs with your debit card.

- Send one-time or recurring checks in just a few taps.

- Deposit checks with your mobile app.

- Make purchases with Apple Pay or Google Pay.

- Pay friends with Cash App, Venmo, or Paypal.

Up to

$1 Million FDIC Insurance

through our partner banks — that’s 4x the coverage from traditional banks.

Unlimited,

free transfers

Easily move money to your investment account and other accounts whenever you want.

$1 Minimum

It only takes $1 to open and there are no account minimum fees ever.

Our vision of

Self-Driving Money™ starts with the Cash Account.

Innovation is in our DNA.

Typical banks let your money sit in your accounts, without finding ways

to earn you more.

We use technology to make you more money on all your money.

Our vision is to optimize the allocation of your money across accounts and put it to work effortlessly. Deposit your paycheck with High Margin Brokerage and decide if you want us to automate the rest with the click of a button. Our software can top off your emergency fund, pay all your bills, and even invest the rest to help meet your goals. We call this future Self-Driving Money™.

As the hub for all your money, the Cash Account is the cornerstone for this vision.

We can’t wait to show you more.

Best

Robo-advisor

For cash

management

As featured in

Our clients number over

400,000Interest paid to clients exceeds

$115 millionLet’s take a breath and review:

Get your paycheck up to two days early

Set up direct deposit and start earning interest on your paycheck. We’ll even pay you up to two days early. The earlier you get your paycheck, the more time you have to earn interest.

Earn a high APY

Earn a 0.35% APY on all your cash. That’s 8x the national average of 0.04% per FDIC.gov.

Enjoy checking features

Whether it’s your rent payment or your credit card bill, paying your bills through your Cash Account is easy to set up. You can even send and deposit checks right from the app.

Access to 19,000 free ATMs

Use your debit card to get cash when you need it.

No account fees, ever

We don’t charge account minimum fees, monthly service fees, overdraft fees, excess activity fees, or other account fees. Keep what you earn.

FDIC insured up to $1 million

Your cash is FDIC insured through our partner banks for up to $1 million. That’s 4x the insurance that the traditional bank provides.

Unlimited, free transfers

Move money in and out of your account as many times as you want. You can easily transfer your money directly to a Investment Account or a` when you’re ready to invest.

$1 minimum

It only takes $1 to open an account and there are no account minimum fees ever.

Finally, a cash account that’s built for you.

We get it: money and its terms can be confusing. We’re here to simplify with answers to some of the most frequently asked questions when it comes to our Cash Account.

Can I move money in between High Margin Brokerage accounts?

You can move money from your Cash Account to your taxable Investment Accounts and IRA Investment Accounts.

Will I be charged any fees?

There are no account fees for the Cash Account. And you don’t pay any fees when you use one of our 19,000 fee-free ATMs – our in-app ATM Finder will show you the location of the closest ones. If you use ATMs outside our network, fees may apply.

How do I withdraw my money?

You can withdraw money at any time. It usually takes about one to three days for your withdrawal to arrive in your bank account. If you’ve recently deposited money into your cash account, it may take a few extra days to process. And you can also get cash from the ATM whenever you need it.

Why is my rate subject to change?

The APY on the Cash Account is dependent on the federal funds rate. We move your funds to partner banks who accept and maintain deposits and pay a rate based on the fed rate. As rates move, we will do everything in our power to keep our rates as competitive as possible.

How do I pay my bills with the Cash Account?

Your Cash Account comes with account and routing numbers, which you can use to pay credit card bills, rent, mortgage and more if the payment platform accepts that method. If you request a debit card, you can use the 16-digit card number to pay your bills. Or, for bills that must be paid by check, you can send a physical check directly from your Cash Account.

Can I get checking features on my Joint Cash Account or Trust Cash Account?

Checking features aren’t currently available for these account types — but we’re working on adding them soon.